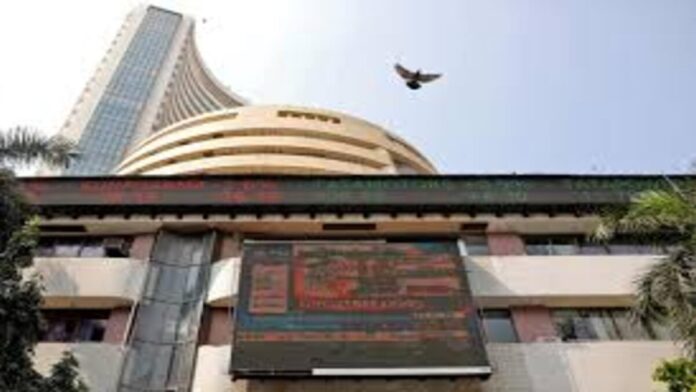

According to the most recent information made available with the exchanges on Thursday, up to three Adani Group firms, including Adani Enterprises, have been placed under the short-term additional surveillance measure (ASM) framework of the BSE and NSE.

Adani Ports and Special Economic Zone and Ambuja Cements are the other two businesses listed by the exchanges in addition to Adani Enterprises.

High-low fluctuation, client concentration, frequency of price band hits, close-to-close price variation, and price-earning ratio are among the criteria for shortlisting shares under ASM.

These businesses have met the requirements to be included in the short-term additional surveillance measure, or ASM, according to the National Stock Exchange (NSE) and BSE.

The applicable rate of margin under the short-term ASM, according to the exchanges, will be 50% or the existing margin, whichever is higher, with a maximum rate of margin cap of 100% starting on February 6, 2023 for all open positions as of February 3, 2023 and new positions created starting on February 6, 2023.

According to market experts, implementing this approach would necessitate 100% upfront margin for intraday trading.

The exchanges added that shortlisting shares under ASM was done solely for market surveillance purposes and shouldn’t be interpreted as a negative action against the firm or entity in question.

A day after the company announced it would not proceed with its 20,000 crore Follow-on Public Offer (FPO) and would instead return the cash to investors, shares of Adani Enterprises dropped nearly 26%. On Wednesday, the stock had fallen more than 28%.

On Thursday, the majority of the other group companies too experienced declines for the sixth day in a row. In total, nearly 8.76 lakh crore has been lost by 10 listed Adani Group companies over the last six days.

Stocks of the Gautam Adani-led company were devalued on the exchanges after US-based Hindenburg Research outlined a long list of accusations in a report, including illegal activities and share price manipulation. The Adani Group has denied the accusations, claiming that it abides by all legal and disclosure obligations.